This is the 2nd part of the article on the effects of Foreign ownership. If you haven’t read part 1 yet than I’d advise you to read it before you jump into the this part. Part 1 can be found here!

2. Foreign ownerships effects – The Externalities of Business football

As I have outlined in part 1 foreign ownership is unfair in nature as the fans do not know if the owner will look at the club as a project (which lets face it most fans would love), nor does the owner sign a pledge to act in the best interest of the club. Some owners might just be there to siphon whatever money is left in the club. But these issues only look at the club itself (partial analysis) and don’t mention what effect the actions of sugar daddy’s have on the league and the national team which the owners don’t account for (general analysis). From this point onwards when referring to foreign ownership I mean ”project” type ownership as this has an external effect which is felt the most even if only a small portion of teams are under this type of ownership in the league at hand.

2.1 Effects on the league (economics, marketability, quality) – It’s all about the money, money, money.

Since I finished Part 1 by looking at the different types of ownership and how they look at the league I shall start by looking at how the exuberant attitude of business ownership might have external effects. Please note that this section will look at externalities/external effect, which means that the owners don’t necessarily want these things to occur and might not even account for them. Another thing to note is that these externalities might be positive for the league) and might be negative. Since in part 1 I concluded that “project” ownership is neutral to the financial success of the league the owners won’t mind these externalities occurring and will not do much (if anything) against it. Whether “project”ownership actually takes a neutral stance or not is definitely up for debate but the assumption of neutrality makes the analysis of externalities simpler.

According to Nauright et al. (2010) the EPL is now a highly commercialised league thanks to foreign ownership. And indeed if we just look at televising deals we will see that the televising rights for 2013-2016 cost BSkyB and BT an astounding £3 billion. This figure is huge by itself but if we compare it to the value of the first EPL televising deal (1992-1997) of £191 million it is evident that the EPL has turned into a marketable league. The reason the EPL has rose in marketability is due to the fact that the “foreign players and managers that are involved in the EPL are generally of an extremely high quality” (Del Bosque, 2010). And indeed it is the quality of the players, managers and ultimately the teams, which make a league attractive but does the league reap the benefits or only the club with the well off owner? The answer is yes.

| Length | Total Value (£mn) | Games covered | Per year (£mn) | Per game (£mn) | Broadcaster |

| 92-97 | 191 | 60 | 38.20 | 0.64 | BSkyB |

| 97-01 | 670 | 60 | 167.50 | 2.79 | BSkyB |

| 01-04 | 1200 | 110 | 400.00 | 3.64 | BSkyB |

| 04-07 | 1024 | 138 | 341.33 | 2.47 | BSkyB |

| 07-10 | 1706 | 138 | 568.67 | 4.12 | BSkyB and Setanta |

| 10-13 | 1782 | 138 | 594.00 | 4.30 | BSkyB and Setanta/ESPN |

| 13-16 | 3018 | 154 | 1006.00 | 6.53 | BSkyB and BT |

The smaller teams benefit from the marketability of the league as well but ONLY because the televising rights are negotiated and distributed centrally. “Domestic broadcast revenue is divided on a 50:25:25 basis; 50% is divided equally between the clubs; 25% is awarded on a merit basis determined by a club’s final league position and the final 25% is distributed as a facilities fee for the number of matches shown on television involving the club.” (English Premier League Website). International broadcast revenue is distributed equally among the 20 teams. Therefore this is a huge positive externality for foreign ownership but only due to the fact that televising rights are negotiated and distributed centrally by the EPL.

It can be argued that a league full of well managed teams would have a high marketability as well but it is definitely undisputed that foreign ownership can act as a catalyst to speed up the rate at which this occurs. The value of the broadcasting deals of the EPL have increased exponentially in the past couple of years and this is to a large extent thanks to the presence of 2 “project” owned teams in the league. However I can’t emphasise enough that it is only a positive externality due to the central bargaining process of broadcasting rights. If these rights would be negotiated on a team-by-team basis the benefits of league marketability could only be reaped by the teams with owners willing to invest in the squad.

This commercialisation of the league allowed foreign owners to focus on a number of different revenue streams which include television rights (apart from the EPL which is negotiated centrally), premium seating options, club branding and other goods and services related (Nauright et al., 2010). The increase in foreign ownership increases the money involved in the league and thus the ability for the league to attract high profile players. This is one of the underlying reasons why the value of broadcasting rights has increased exponentially: the more marketable names are in the league the more value it can fetch in the market. However it is important to note that these marketable players should be dispersed in the league more or less evenly. If the title competition is shared by many teams (top 6 last year) and the season is only decided until very late into the season (last day of the season last year) the more the league can ask for its broadcasting rights.

Another interesting point Nauright et al. (2010) makes is that the increase in foreign ownership is linked to the commodification of the EPL (just to clarify commodification basically means turning something into a ‘commodity’. A Marxian example is commodification of labour in capitalism which means that in order for labour to survive in a capitalist system they have to sell their expertise, essentially commodifying themselves). The intriguing point this implies is that although “project” ownership catalyses the process of commodifying a league (by making it marketable), by doing so it attracts other foreign investors to the league who are not necessarily of the “project” type. Therefore in the EPL Abramovich’s attitude towards Chelsea FC initiated a whole spiral which commodifies the league further. However at this point the commodification of the league is not an externality but an aim for the clubs which ended up with an ownership of the “self-sustaining” type (such as Kroenke of Arsenal FC, Short of Sunderland, Henry of Liverpool). This spiral only occurs in leagues where televising rights (which are affected the most by the commodification of the league) is negotiated and distributed centrally!

Although foreign ownership undoubtedly makes a league more marketable, Nauright et al. (2010) warns us that both players, and the ‘Americanization’ of management/marketing have to be incorporated with moderation into the league otherwise there is a potential that the foreign catalyst displaces the English core.

2.2 Effects on transfer market and wages – Exuberant Inflation

It is important to make a distinction between wages and transfers (eg: one cannot say that Robin Van Persie cost Manchester United £70 million) The reason behind this is because the transfer value can be looked at as an investment where the enterprise acquires an asset. However wages come out on the operating side of the enterprise. Therefore it is vital to keep the two concepts separate from each other. This distinction is more important for regulators (such as FIFA) who want to create financial rules (such as FFP) than it is to the everyday fan but I’d like to ask the reader to keep this in mind when reading through this section.

First let’s look at transfer activity and how foreign ownership has affected it. In order to do this however we have to construct a Price index so we actually know what the real value of the players are. The Bank of England (and every Central Bank of the World) produces Consumer Price Index (hereinafter CPI) which is a comprehensive measure of inflation for consumer goods. However since the football player market is not really a consumer good we cannot rely on CPI data to measure inflation in the transfer market. Fortunately for us Tomkins et al. (2010) already constructed such a figure and termed it the Transfer Price Index (hereinafter TPI). The idea is to take the average transfer values of a base year and see how the average transfer value of players in other seasons compare to this value. The reason we take averages is due to what statisticians call the ‘law of large numbers’ which essentially means that the trends will emerge the more observations we take into account.

If Tomkins et al. (2010) 2011/2012 update is to be believed ever since the creation of the EPL (1192) there has been a rocking 730% inflation on average transfer value. For comparison the Bank of England in the same period recorded a 77,1% inflation in CPI. To put this into perspective: The record signing of £5 million of Chris Sutton to Blackburn in 1994 is today’s average transfer price while the record transfer made by a Premier League side is £50 million submitted by Chelsea FC for Fernando Torres. However it is important to note that TPI doesn’t increase year-on-year which is shown in the figure below.

So some important dates to go with: Roman Abramovich purchased Chelsea FC in June 2003; Sinawatra bought Manchester City in 2007; September 2008 marked the purchase of Manchester City by Sheikh Mansour bin Zayed Al Nahyan; 2010-2011 season is the first season with the 25-an rule in place the EPL. With these in mind when looking at the above figure we can see that it took 2 not just 1 “project” owned firms competing with each other to have an extensive effect on transfer prices. One might argue that this is logical as the two sides will try to outbid each other which leads to a flurry of astounding bids. Of course every club is aware of the soft budget constraint these firms have and will hold off their supply of players until a huge offer is received. This is the rational behaviour of the clubs as they have to balance the books at the end of the day and selling a player for a vast sum can finance their own transfer activities. However other clubs will be aware of the sell and of the approximation of the transfer sum and they in turn will up their asking price for their own players. A perfect example of this chain reaction is the Fernando Torres and Andy Carroll sale. Liverpool sold Torres for an astounding £50 million to Chelsea and then enquired about Andy Carroll. Newcastle were aware of the Torres sale and told Liverpool that they would only part ways with Andy Carroll for a heftier sum. In the end Liverpool bought Carroll for a massive £35 million. Whether the sum paid by both clubs is reasonable is not the point of this piece but it perfectly illustrates the chain reaction which leads to inflationary pressure on the transfer market.

The drop in transfer prices in 2009-2010 can be attributed to the effects of the credit crunch which led to less transfers which were of lower prices as teams became more risk averse. However such a trend was stopped thanks to the FA with the introduction of the 25-man rule in 2010 as a means to save the English national team. This lead to English players ‘turning into gold’ and their prices shooting up on the transfer market. One just needs to look at Liverpool’s squad and the amount spent to assemble it to see the adverse effects of the 25-man rule. In conclusion: it was a mixture of “project” ownership and the FA’s decision that lead to the inflationary pressures prevailing in the EPL right now.

If you are a theorist and would like to explain the TPI fluctuations in terms of a general model then I feel a good starting point would be the shortage phenomena as outlined by Kornai (1992) mixed with the inelastic supply of players. I will not go much into detail about this in this piece as it would be too much of a tangent from the original question: What are the externalities of a “project” type ownership? Having said that if there is a demand for a piece to outline a general model of transfer activity I will write one up. Just leave me a comment if you would like to read about what I think is a good model to explain transfer prices.

Now let us turn to the wage bill of the big six (Arsenal, Liverpool, Manchester United, Manchester City, Tottenham, Chelsea) in the EPL. To some extent wages are more important than transfer prices as Kuper et al. (2012) find that 90% of league position can be explained by the wage bill of a team. Of course this doesn’t mean that the path to glory is to offer your players as much money as you can. Also this 90% correlation between the data doesn’t take into account the incentive schemes put in place via the wage structure of a team. Please note that I will use data up until 2011 because some teams have not yet published their 2012 annual reports at the time of the writing. Also these wage bills represent total wages of a club so they include: first team players’ wages, reserve team players’ wages, coaches wages, board members wages, other staff (medical, scouting, match-day staff) wages, pensions and insurance, and bonuses. Therefore the below figure will have some uncertainty but we are only interested in the general trend which the below figure clearly shows:

Data for Manchester City and Tottenham for the years 2003 and 2004 not available (if anyone knows them please leave it as a comment below and I shall edit the figure)

Tottenham’s admirable performance for the wage bill they have is clearly shown in the figure. They have the lowest wage bill of the big 6 and perform at a level to compete for a Champions League spot. Sure they only made it to the Champions League once but for a wage bill that low compared to other teams that is an achievement worth mentioning. Liverpool’s abysmal wage policy is also apparent in the figure as they have now overtaken Arsenal with their wage bill but have finished several positions below Arsenal. This is surely something Brendan Rodgers will have to address if he is to make it at Liverpool.

From the figure we can see that Chelsea and Manchester City have the highest wage bill which is not much of a surprise if we take into account their soft budget constraints. In fact we can see a sharp increase in Manchester City’s and Chelsea’s wage bill after their sales. The reason behind this is quite intuitive: Both teams wanted to attract big names to the team and since they didn’t have the marketability and tradition of Liverpool and Manchester United they had to lure the player with the help of what they had more of than their competition: money. To lay the blame completely on the teams (“oil money”) and the players (“money grabber”) is not completely justified though as the presence of agents in the modern game definitely play a huge role in the wages the players earn.

The figure above leads to a question which is beyond the scope of this piece but is worth thinking about: Is tradition/football culture a substitute for money in football? Looking at the above figure it can be argued so as it is not unheard of for players to take a wage cut in order to transfer to a team (Arteta to Arsenal) but it is mostly true for players who transfer to a team with a long-standing, proud tradition or to a team with a Champions League spot. Another question that this raises: Once Chelsea and Manchester City cement their place as a consistent dominant force in Europe will they relax their wage bill? It is hard to tell right now but if they do so it will require massive wage restructuring. Whether they aim to do so remains to be seen-

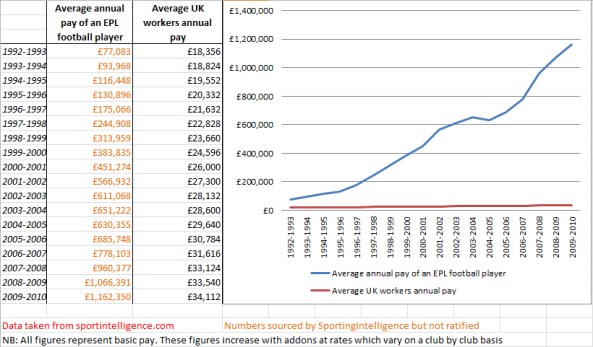

Now let us look at how the wage bills of these teams affect the overall average annual pay of an EPL football player. The argumentation is the same as it was for transfer prices: Chain reaction. I find myself in a fortunate position (again) as sporting intelligence has published the average footballers wages in England from the 1992-1993 to the 2009-2010 season. We have to keep in mind that the figures are merely guestimates so we can’t take their values quote for quote; however we are only interested in the general trend of wages therefore we need not worry about the exact value of the average annual pay of an EPL footballer in a specific year.

From the figure above the reader can see that although wages increase at a tremendous rate in the EPL, compared to the real sector of the economy, foreign ownership doesn’t seem to have any distinguishable effect on average wages. So then why did wages rise so dramatically? Kuper et al. (2012) argue that the rate at which football wages are rising can be explained by the principal-agent problem (note: agent in this case refers to the players not to the players agents. I’m sorry for the confusion this may cause but this is how it is termed unfortunately). They argue that wages have increased as a way to increase incentives and the reason wages have risen at such a preposterous rate is because the effort of football players is unobservable, therefore to minimize shirking the players are offered massive wages and frequent rises to increase the incentives of work. However I argue that the effort of a football player is anything but unobservable. In fact nowadays football practices can be visited, not just games so incentives to perform should already be in place since monitoring of effort is outsourced to the fans for money. I think the answer behind the massive rise in football players wages lies in the presence of players’ agents, and the ability to soak up an operating loss.

The fact that the EPL has become highly commercialised has already been looked at. This has led to more commercial income for all the teams in the EPL, however players’ agents are also aware of this fact and their aim is to appropriate as much of that extra income for their client as possible (within reasonable means of course). Thus as the teams gain more revenue the more agents will want for their client. The presence of agents therefore acts as an inflationary pressure in the football world and the teams with the biggest revenue streams are expected to have the largest wage bill assuming they have a hard budget constraint. The reason teams with a soft budget constraint won’t fit this trend is because they can successfully soak up an operating loss (in the short run). With these two conditions in mind it is not surprising that the 2 teams with the largest wage bill are teams with soft budget constraint while 3rd place is the most financially successful team in the EPL.

The reason players’ agents can act as a catalyst is asymmetric information. These agents know how many teams are in the race for the player he/she represents but the teams negotiating do not. This is a reason why free and cheap transfers are attributed with high wages as there is a potential for many teams willing to match the price. This is also the reason behind high profile players sometimes earning ludicrous amounts: Ibrahimovic reportedly earns over £900,000 a week. This wage is rational given the fact Manchester City and Chelsea might have been interested in the services of Zlatan as well something his agent knew for certain while PSG didn’t.

Now there is a problem with this, which the UEFA has realised: Gianni Infantino, UEFA’s general secretary has said “this [spending spree] may be sustainable for a single club, [but] it may be considered to have a negative impact on the European club football system as a whole. […] The problem is that all clubs try to compete. A few of the biggest can afford it, but the vast majority cannot. They bid for players they cannot afford, then borrow or receive money from their owners, but this is not sustainable, because only a few can win.” What this basically means is that this high inflation in players wages and transfer prices might be sustainable for a very few in the short run but in the long run it may lead to the destruction of several football clubs. Long story short: football is a bubble economy and if it bursts many teams will have to go into voluntary bankruptcy. Teams who have strict financial rules in place won’t really be affected by this; while the teams that are amassing huge debts will be in trouble unless they are able to get rid of their debts.

That’s it for Part 2. Part 1 covered the different types of Foreign ownership. If you missed it click here! Hit the follow button on the right if you don’t want to miss Part 3 which will look at the effects of foreign ownership on youth development and the English national team. The FAs 25-man rule will be looked at as well.

_______________________________________________________________________________________

Sources

- Del Bosque (2010). Spain Coach Vicente Del Bosque Insists Foreign Premier League Players Are Not Damaging The English National Team. Available at http://www.goal.com/en-india/news/477/euro-2012/2010/09/22/2131418/spain-coach-vicente-del-bosque-insists-foreign-premier

- English Premier League Website. Retrieved from http://www.premierleague.com/page/Contact/0,,12306,00.html

- English Premier League History. Retrieved from English Premier League website. http://www.premierleague.com/page/History/0,,12306,00.html

- English Premier League News. Retrieved from English Premier League website. http://www.premierleague.com/page/History/0,,12306,00.html

- English Premier League Team Profiles. Retrieved from English Premier League website. http://www.premierleague.com/page/manchester-united

- Kornai, J. (1992) The Socialist System: The Political Economy of Communism

- Kuper, S. & Szymanski, S. (2012) Soccernomics: Why England Loses, Why Spain, Germany, and Brazil Win, and Why the US, Japan, Australia, Turkey-and Even Iraq-Are Destined to Become the Kings of the World’s Most Popular Sport

- Nauright, J & Ramfjord, J (2010). Who owns England’s game? American professional sporting influences and foreign ownership in the Premier League. Models of Football Governance and Management in International Sport. 11, 4. Available at http://www.tandfonline.com/doi/abs/10.1080/14660971003780321

- Tomkins, P., Riley G. & Fulcher G. (2010) Pay as you Play: The True Price of Success in the Premiere League Era

- Transfer League. www.transferleague.co.uk